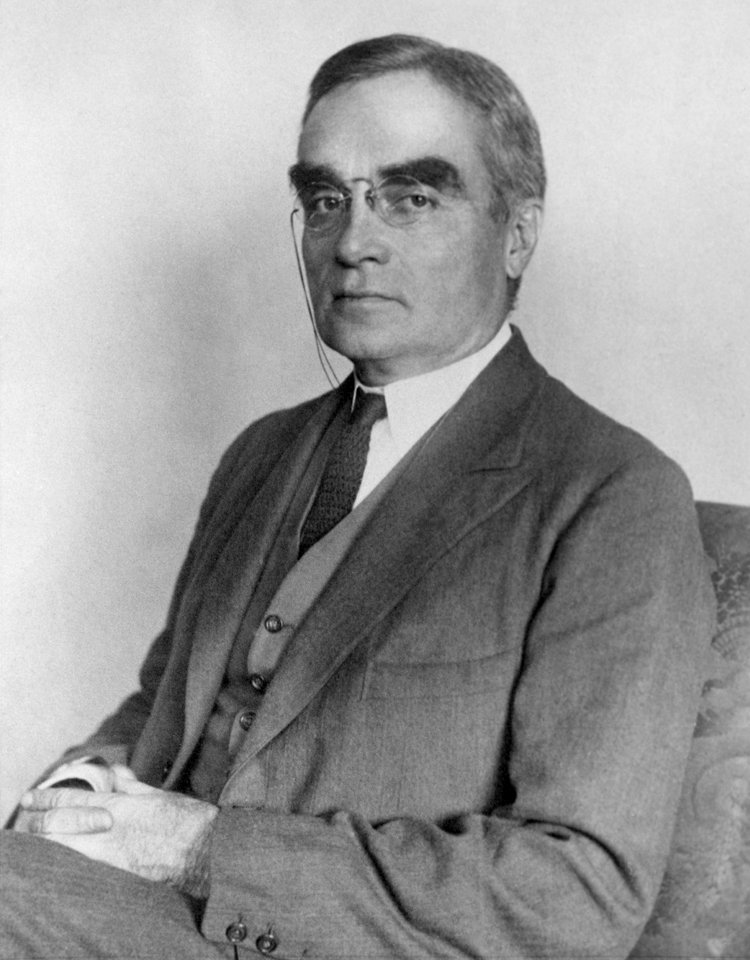

“Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury… for nobody owes any public duty to pay more than the law demands.”

Gregory v. Helvering (2d Cir. 1934)

Judge Learned Hand

Freedom from Property Management

-

The Challenge You Face

After years of managing properties, you're tired of:

Midnight maintenance calls

Tenant screening and relations

Property manager oversight

Vacancy concerns

Repair and maintenance decisions

-

The DST Solution

Professional institutional property management teams handle:

All tenant relations and leasing

Comprehensive maintenance programs

Financial reporting and accounting

Strategic property improvements

Market analysis and positioning

Potential for Increased Cash Flow

-

How DSTs May Increase Your Income:

Professional management efficiency often reduces operational costs

Institutional-quality properties typically command premium rents

Economies of scale in maintenance and improvements

Strategic property positioning in strong markets

-

Real-World Impact - Many investors transitioning to DSTs experience:

More consistent monthly distributions

Reduced unexpected expenses

Professional financial reporting

Diversified income sources

-

Risk Considerations:

Distributions are not guaranteed

Property performance affects income

Market conditions impact returns

No control over distribution or sale timing

Tax Advantages and Estate Planning

-

1031 Exchange Benefits:

Defer capital gains taxes when transitioning from owned properties

Maintain real estate investment exposure

Potential for multiple subsequent exchanges

-

Estate Planning Advantages:

Simplified transfer to heirs

Professional management continuity

Potential step-up in basis benefits

Reduced administrative burden

-

Important Tax Considerations:

Complex rules require professional guidance

Boot limitations in exchanges

Ongoing tax implications

State tax considerations vary